Sample Gift Letter To Family Member

Sample Gift Letter To Family Member - Matt Webber is an experienced personal finance writer, researcher and editor. He writes extensively about the impact of personal finance, marketing and technology on contemporary art and culture. A gift letter is a legally written letter that clearly states that money received from a friend or relative is a gift.

Source: templatelab.com

Sample Gift Letter To Family Member

The most common use of gift certificates is to help a borrower repay a down payment on a new home or other property. Such letters state that the money received is not to be returned in any way, in any form. If you received a gift from a friend or family member to buy a property, your mortgage provider may ask you to sign a gift letter.

This guide explains what gift letters are, how and why to use gift letters, and the tax implications of gifts. A gift letter is a formal document confirming that the money received is a gift, not a loan, and that the donor does not expect you to return the money.

A gift can be broadly defined as involving the sale, exchange or other transfer of property from one person (giver) to another person (recipient). Typical forms of gifts include: Gift letters in the form of shares accompany the sale of homes below market value. This usually happens when someone gives a property to a relative.

What Is A Gift Letter?

Gift letters can include any type of gift for any purpose, but are most often used in the process of applying for a mortgage to buy real estate. If you bought a property and received a gift of money that you plan to use for mortgage payments or closing costs, you must provide a gift letter proving that the money is not a loan.

Source: parentbooster.org

During the mortgage underwriting process, the lender may check the financial status of the loan applicant to ensure that they have the funds to repay the loan. In addition, this additional liability may be taken into account when considering the price and terms of the mortgage contract.

For example, let's say you just got married and your grandparents gave you $5,000 as a wedding gift. You can use this money for a down payment and home closing costs, but to do so, you need to reassure your mortgage provider that it's not a loan.

To do this, you can ask your grandparents to write a gift letter for you and give it to your mortgage lender. The gift letter states your relationship, the exact amount and source of the funds, and states that you have no obligation to return them.

Gift Letters And Mortgages

If so, make sure it's from an eligible donor. Gift letter requirements and acceptable donors vary by mortgage type. Gift letters follow a fairly standard format, but some mortgage lenders (or other financial institutions) prefer to use templates. Generally, the donor must write and sign the gift letter.

Ideally, a gift letter should accompany the gift, but this is not always done and the letter can be written and signed later. Please note that the mortgage lender will carefully investigate the circumstances of the gift and may request further information or evidence regarding the gift.

Source: static.vecteezy.com

This may include bank statements, copies of checks and proofs of wire transfers. This study is designed to verify your financial situation, assess your risk and make sure you are able to repay the loan, which includes the money transferred. Multiple gifts can be used for an advance, but each must have a separate gift letter.

Contact your mortgage provider for the evidence you need to provide in your gift letter. Otherwise, your application may be delayed. Not all gifts are taxable. Gifts that fall into the following categories are tax exempt: If the gift is taxable, the gift tax is normally paid by the donor, unless the recipient of the gift agrees to pay.

How To Write A Gift Letter

As of 2022, the Internal Revenue Service (IRS) has set an annual donation exemption of $16,000 per person. In 2023, this gift tax exemption will increase to $17,000. This means that the donor must pay tax and file a gift tax return for the excess amount.

For example, if someone gave you $25,000, that person would have to pay tax on the amount in excess of the annual exclusion amount. In 2023, it will be $8,000. Finally, note that even if the gift amount falls within the IRS gift exemptions and exemptions, the donor still needs to file a tax return for it to count as a lifetime tax exemption.

Certain types of gifts are exempt from tax. These include gifts that do not exceed your annual deductible for the calendar year, tuition or medical expenses, gifts to your spouse or gifts to political parties. Yes. The gift letter is a legally binding document as the loan documentation is entered into the register.

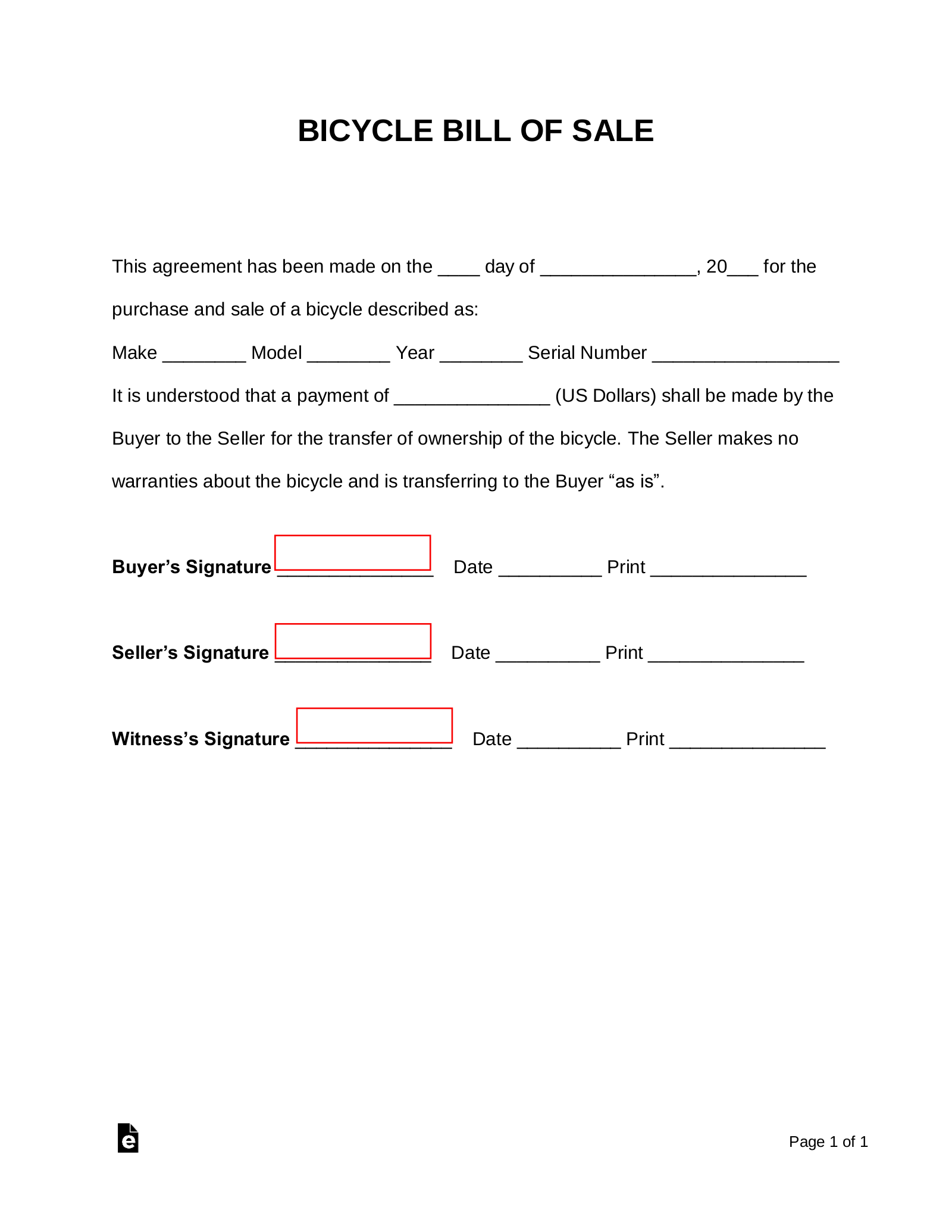

Source: eforms.com

Source: eforms.com

Gift letters are legally binding, so the lender requires the donor's signature. It is not so important that the recipient signs the letter. Most mortgage providers have templates you can use, but in general gift letters should include: so that you get your money back.

Gifts And Taxes

Gift letters can include any type of gift for any purpose, but are most often used in the process of applying for a mortgage to buy real estate. Revenue Service. "IRS provides tax inflation adjustment for tax year 2023." Little Green Light is a cloud-based fundraising donor management system.

Subscribe to receive the latest product updates, best practices, and tips for growing your nonprofit. If your organization receives a memorial gift, it is best to notify the family of the deceased. Since a memorial letter is different from a gift letter, we have prepared sample language to help you write this kind of letter. Below is an example of a letter I sent to my surviving spouse.

We are honored to honor Ryan's memory and his commitment to protecting the earth. To date, I have received the following gifts in his memory: John Smith 12 Main St. Plymouth, NH 03876 Michael Douglas 1 South Washington St Bristol, CT 06010 On behalf of our organization, we would like to thank these generous donors.

I am sharing my address in case you want to contact me directly. After receiving your gift, we will periodically send you the names and addresses of additional donors. When creating your own obituary letter template, keep the following in mind: If you are looking for more guidance on how to handle memorial gifts, please refer to this article: Approval of memorial gifts: What you need to know A comprehensive guide to recognizing donations received by your non-profit organization Download

example of gift funds letter, free gift letter, family member gift letter template, financial gift letter template, gift funds letter template, gift card letter template, bank gift letter template, free gift letter sample