Printable Family Member Gift Letter Template

Printable Family Member Gift Letter Template - It is common for a home buyer to receive a financial gift from family members, relatives or even close friends. However, there are some rules to follow in order to use it to participate. Follow this real estate gift deed template to avoid any problems when buying a new home.

Source: templatelab.com

Printable Family Member Gift Letter Template

We have a free letter to download that most mortgage lenders will accept. We have also compiled various rules and regulations that must be followed when gift funds are used for a down payment or mortgage application. When you apply for a home loan, lenders check your financial standing to determine whether you can repay the loan.

They want to see if you are tough or if you are very vulnerable. Enter your email to receive a real estate gift letter template. We respect your privacy and hate spam. Cancel your subscription at any time. Many different factors are used including your credit score, how much you earn and how much debt you have.

Submit your latest bank statement, salary and other financial documents to the lender and they will verify everything. One important thing is the debt to income ratio. Lenders look at this to make sure you have enough money to pay off debts you've already agreed to (like car loans, credit cards and student loans) in addition to your new mortgage debt.

What Is A Gift Letter In Real Estate?

The mortgage lender must ensure that any cash gift you receive does not have to be repaid. This will affect the debt to income ratio. Therefore, documentation of the gift deed is required. Any additional encumbrances you may have that affect your mortgage payments are reviewed.

Source: templatelab.com

Check with your lender to see if your loan program does not accept gift payments. I bet they are. Finally, this letter is only valid for a cash gift. You can also get equity, but that's another topic. This letter applies to any form of money you may receive to help you buy a home.

Depending on the type of loan you are getting, there are different requirements. Here are just a few. It is important that you speak with your loan officer. Each lender may have different rules that must be followed as part of the process. Talk to them early, as any problems with loan processing can cause a delay in closing and taking possession of your home.

While there are no set rules for how much is considered a "gift," most lenders will want an explanation for any amount you receive that is half your monthly income. Example: Your monthly income is $5,000, so any gift over $2,500 will require a gift letter.

What Is A Gift Letter In Real Estate?

FHA loans allow you to receive a gift from any family member (except cousins, nieces and nephews). Additionally, you may receive a monetary gift from someone involved in your life. This can include employers, friends and even exes. FYI, the advantage of an FHA loan is that your credit does not have to be perfect, and you may also have lower down payment options.

Conventional loans can accept gift cards from any family member: your spouse, your parents (biological, adoptive, step and foster parents who all qualify), your grandparents or great-grandparents, your aunts and uncles (including half-cousins), your relatives (including step- and adoptive parents), your nieces and nephews (including half-cousins), your in-laws (including parents, grandparents, aunts, uncles, brothers-in-law, sisters-in-law and future in-laws), your children (biological, adopted, step-children) and

Source: formspal.com

Source: formspal.com

adopted children are all eligible), your siblings (including half-cousins, adoptive and adoptive parents), your domestic partner, your fiance or fiancee. There are very few restrictions on accepting a cash gift when you get a VA loan. The only exception is that the person providing the money cannot be an interested party or a person who has a vested interest in the sale.

Examples of this are: the person selling the home you are buying, the person or company who built the home you are buying, the developer of the home you are buying, your real estate agent or the seller's agent. The rules for accepting gifts when applying for a USDA loan are the same as for the VA loan above.

Gift Letter Rules For Different Loan Types

If the participating gift is less than $16,000, you do not have to report it to the IRS. Yes, the gift certificate is legally binding. That is why. Mortgage fraud is a real thing. Lying on your mortgage application is mortgage fraud. By not being honest about where your down payment funds are coming from, you are committing fraud.

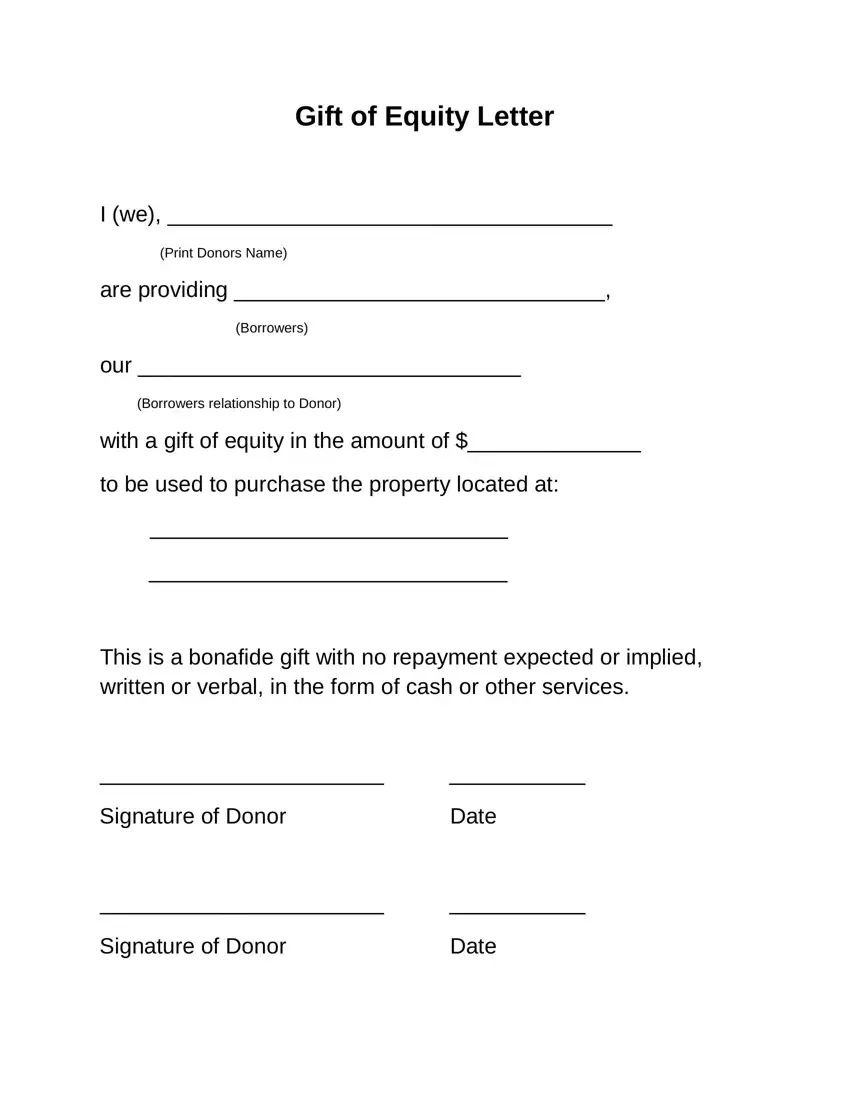

A gift deed is considered a legal instrument because it is signed that the money is not considered a loan. Each lender may require different components of a gift letter, but most require these six things: There are a few things to keep in mind when giving or receiving a gift.

The biggest one is that the person giving the gift must be on the list of accepted persons, depending on the type of loan. For example, if your relative wants to make a down payment gift and you are getting an FHA loan, this would NOT be allowed (relatives are not allowed to make gifts under FHA rules).

Source: www.freebiefindingmom.com

Source: www.freebiefindingmom.com

However, other family members would be fine. Also, depending on the type of loan, you can receive the entire advance as a gift. FHA allows the entire down payment to be donated. Conventional loans require the home buyer to pay an amount out of pocket if they put less than 20% down.

Gift Letter Rules For Different Loan Types

Your lender can explain more, as amounts and percentages vary depending on the terms of the loan. The easiest way to validate your gift money is to use the template I provided or create your own letter using the 6 steps above. I also recommend being upfront and open with your loan officer during the process and letting them know from the start that some (or all) of the down payment is a gift.

Downpayment gifts can have strings attached, and lenders want to make sure they don't come with any repayment conditions. You will also be required to show your lender recent bank statements. They will ask for large deposits which can be red flags and demand an explanation.

Sometimes the donor may need to provide receipts to prove that the money came from their account. Fannie Mae and Freddie Mac are the major mortgage finance companies in the US. Freddie Mac has some gift guidelines: Your entire down payment can be gifted by a relative if you're buying a single-family home as your primary residence.

As long as the money comes from an approved donor (see list above), it can be used to buy a first home or buy a second home. It usually doesn't matter if it's a single family home, apartment, duplex, or other type of property. When looking at other properties or investments, I recommend that you always check how much money the place will generate as cash flow.

bank gift letter template, estate gift letter sample, formal gift letter, money gift letter template, cash gift letter template, gift of funds letter, gift funds letter template, free gift letter template