Gift Letter For Mortgage Template Pdf

Gift Letter For Mortgage Template Pdf - Most special loan programs allow you to use gift funds from family to cover some or all of your down payment and closing costs when you buy a home. But you will need a strong donation letter and other documentation from you and the donor.

Source: data.templateroller.com

Gift Letter For Mortgage Template Pdf

The lender must ensure that any money received is not a loan. A loan will increase your monthly debt payment and debt-to-income ratio, potentially keeping you on top of your debt. Yes. All major programs require you to provide the donor's bank statement showing that the donation funds have been deposited into their account.

Yes. You must provide a bank statement or confirmation from the escrow company showing that the money has been received. Are you here. A seller's loan or a loan from another party to the transaction is considered a contribution from an interested party. These are allowed to certain limits.

They can only be used for closing costs, not payments. The only exception is when a family member sells to another family member who provides a gift of equity in the home they are selling. Always check with a CPA before doing taxes, but in general, estate agents don't pay taxes on gifts they receive.

A Word About Donor Privacy

Donors may be required to pay tax on gift amounts of more than $16,000 in 2022 and $17,000 in 2023. Donors can avoid paying tax by paying two credits on personal gifts of $16,000 in the year 2022, for a total award of $32,000. Check with your CPA before transferring money.

Source: i.pinimg.com

You will need a grant letter for any amount that will be a large deposit. It is usually defined as 1% of the sales price for FHA, 50% of the qualified gross income, and any mortgage that appears to be illegal for USDA and VA loans.

Yes. A spouse who does not want to be in debt can give a cash gift to the loan applicant. Your donor is already helping a lot by giving a matching gift. It is usually not appropriate to ask for their bank details where the bonus funds are issued.

Unfortunately, this law is an impossible debt. Many donors have a problem with confidentiality, which is understandable. One certainty is that lenders now use security systems mandated by government agencies and generally check to ensure the security of mortgage documents. The above attempts to assure the letter that their information will be kept confidential and secure.

Bottom Line: A Gift Letter Is Worth The Effort

Yes, it's a foolproof system, but a lot of thought goes into data security among today's lenders. It is often difficult to get all the documents you need to get a mortgage loan. But the work is worth it. Home ownership is your ultimate goal and mortgages allow you to do that.

Just a few weeks of homework and follow-up, and you can finally own a house. Tim Lucas spent 11 years in the mortgage industry helping hundreds of mortgage clients from all walks of life, from first-time buyers to multi-million dollar home purchases. He bought his first home at age 26 with only $1,100 out of pocket and now owns $2.4 million in real estate.

Source: templatelab.com

Tim is managing editor at the national websites TheMortgageReports.com, MyMortgageInsider.com, and Home.com. He combines hands-on experience with his editorial background to bring the unvarnished truth about mortgage issues. Tim has been featured in publications such as Time, US News, MSN, and more. Connect with Tim on LinkedIn and Twitter.

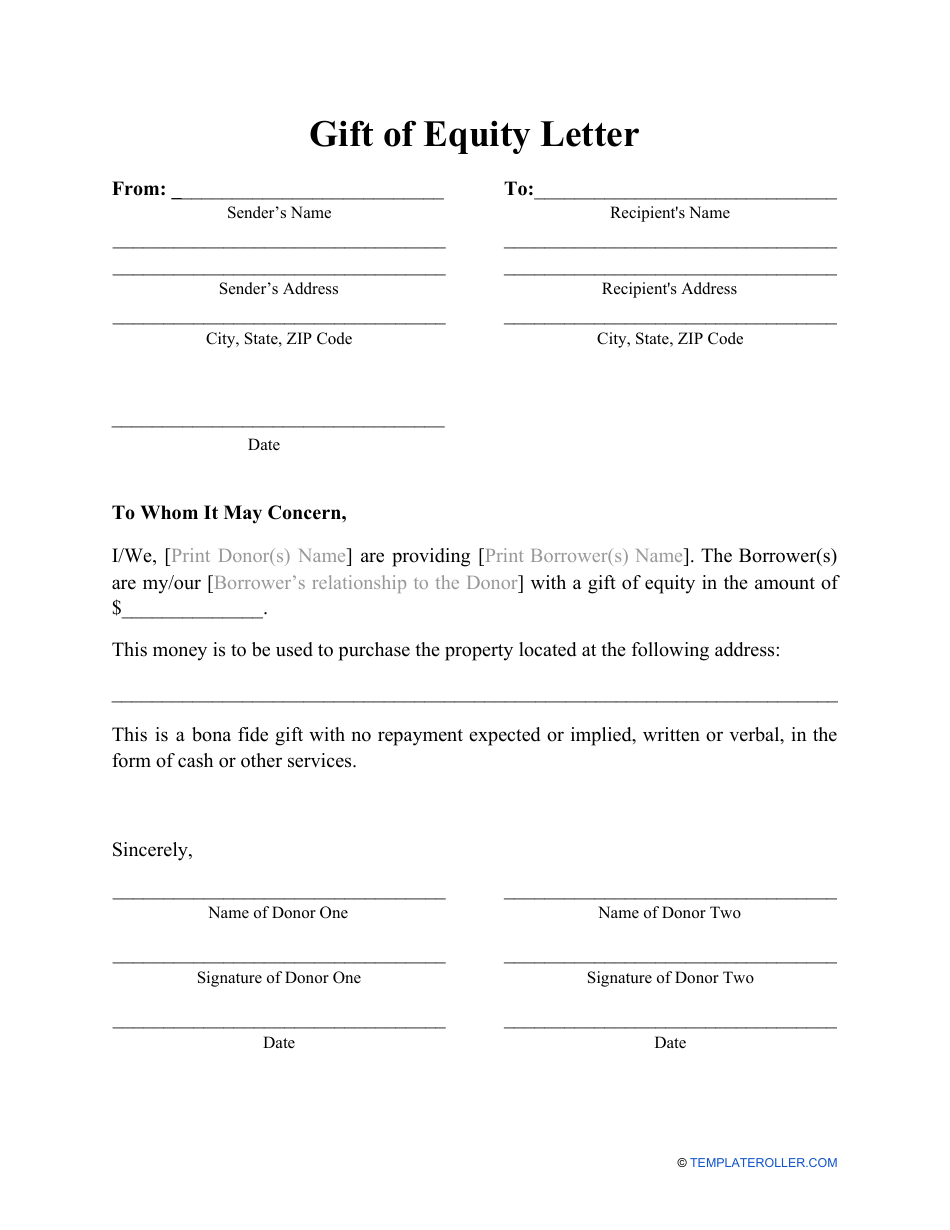

Your email address will not be published. Required fields are marked * A mortgage donation letter (donation registration) is a sworn statement certifying that the funds used to purchase the property are a donation and not a loan. Lenders require grant letters as proof that there are no payment obligations attached to the grant and that there are no conflicts of interest.

Bottom Line: A Gift Letter Is Worth The Effort

Grant funds can be used for a down payment or closing costs. To provide proof to a lending company that the funds being expressed are not unspecified loans. Therefore, the amount paid does not affect the borrower's ability to repay the loan. A mortgage offer letter is a confirmation that money has been given to a recipient for a down payment, closing costs, or other expenses related to the purchase of the property.

It must be signed by both parties and the recipient to ensure that the payments are not part of the loan or a separate agreement. Donation funds for deposit cannot come from one person. Instead, major lenders require donors and recipients to share a family relationship.

Acceptable donors include direct relatives and non-relatives of the recipient, such as former family members, godparents, or domestic partners. The donor may not be associated with any party to the real estate transaction (other than the recipient), including the developer, agent, or other interested party or organization.

Source: data.templateroller.com

Source: data.templateroller.com

A valid mortgage donation letter should include donor information, details about the donation, statements confirming the nature of the donation and disclosing any conflicts of interest, and supporting documents. Mortgage offer letters should always include the lender's basic contact information, including a phone number (required by Fannie Mae and other lenders).

Main Purpose

The recipient's name and their relationship with the donor should be stated in the letter. The letter should include the dollar amount of the gift and the shipping date. The donor must also disclose the source of the donation, including the company name, account name, and account number.

Additional supporting documents may be required. Both the donor and the recipient must sign the donation letter. The document does not need to be notarized. Federal loan sponsors such as Fannie Mae and Freddie Mac limit the amount of money you can use as a gift.

For some types of mortgages, borrowers must contribute at least 5% of their personal income. In addition, Freddie Mac imposes additional restrictions on investment properties and shared equity mortgages. * Loan-to-value ratio used to assess the level of mortgage loan risk Most lenders require proof of loan placement in addition to the loan letter.

Usually an electronic transfer document or a copy of the scan and deposit is accepted. Borrowers should check with their lender to make sure all required documents are sent with the offer letter. Generally, mortgage donations below a certain threshold are not required to be reported to the IRS.

printable mortgage gift letter, fha gift letter pdf, free printable gift letter mortgage, free mortgage gift letter pdf, printable mortgage gift letter pdf, gift letter template word, gift letter for mortgage template, gift letter for mortgage