Gift Exchange Fill Out Form

Gift Exchange Fill Out Form - Form 709 is used to report any taxable gift money that is subject to gift tax or inheritance tax to the IRS. This form is called a gift (and inheritance) tax return. Form 709 is used to report taxable gifts made during the taxpayer's lifetime, and also allocates the taxpayer's lifetime use of the generation-skipping transfer tax (GST) exemption.

Source: cdn.shopify.com

Gift Exchange Fill Out Form

Below is the form for the 2022 tax year, which you will submit by Tax Day in 2023. The IRS usually releases a new form each tax year. Large estates are taxed on their value when a person dies and leaves assets to beneficiaries. Someone can avoid estate taxes by giving their money away over time, which is why the federal gift tax exists.

Reporting the gifts on Form 709 and the potential tax ensures that the IRS is not caught because there is no estate left to pass on after death. If you make one or more transfers of money or property, you may have to file IRS Form 709 and pay gift tax, but there are some exceptions you should be aware of first.

The recipient of the gift is not responsible for this tax. The person who gave the money as a gift must file Form 709 and pay the tax due—if the gift qualifies. In general, gift tax applies to the transfer of property from one person to another where the recipient does not pay fair market value for it.

How Tax Form 709 Works

For example, if a parent transfers their home to their child for $1, gift tax will be payable on the difference between the fair market value and the amount actually paid. To do this, you must complete IRS Form 709. Giving someone an interest-free loan is considered a gift, as is forgiving a loan or canceling someone's debt.

Source: pbs.twimg.com

The IRS offers an interactive Form 709 on its website. You can complete it online, then save and print your completed version. You must complete Form 709 whenever the total value of all gifts you give to an individual in the same calendar year exceeds the annual limit, which was $16,000 for tax year 2022 and $17,000 for tax year 2023. The first is

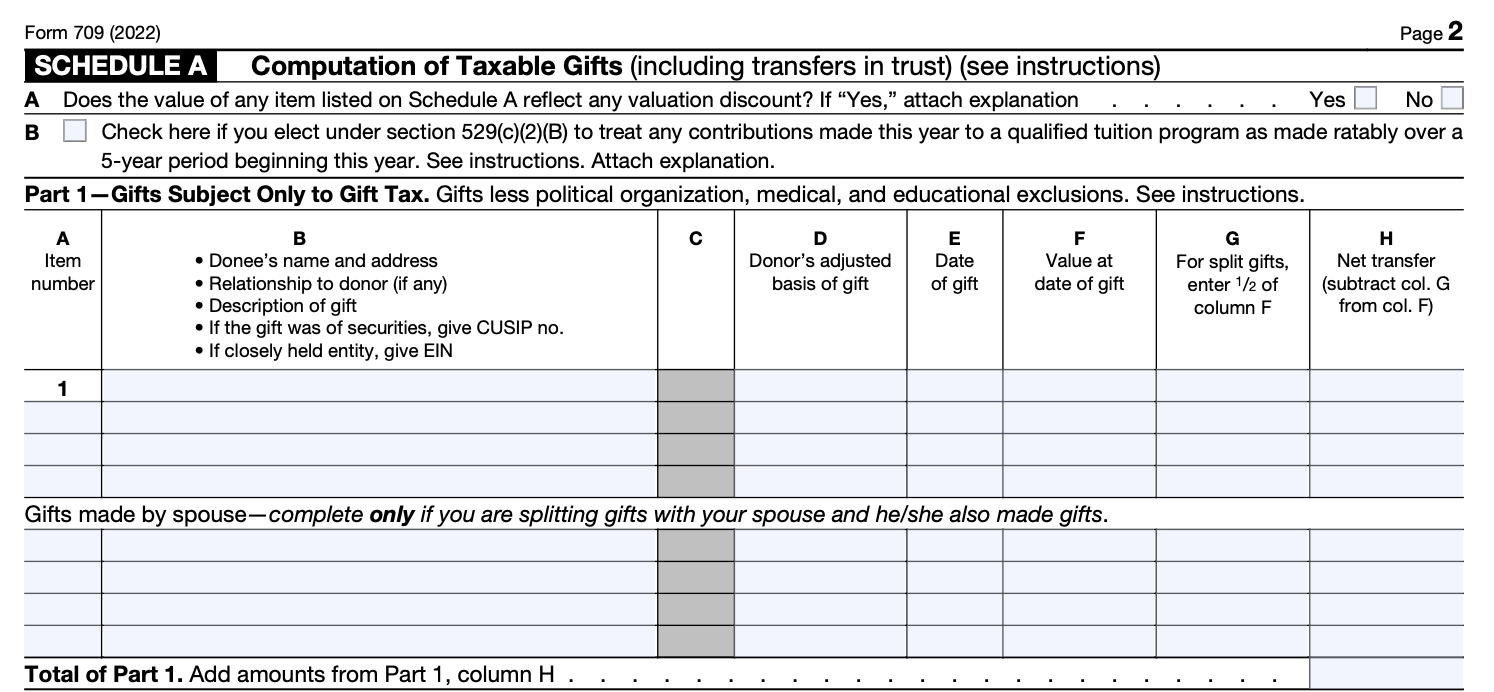

part of Form 709 for general information. It consists of a series of fill-in-the-blank questions designed to identify you and the nature of your gift or gifts. The second part of Form 709 guides you through the process of calculating the tax due. Schedules A, B, C, and D on pages 2-5 of the form allow you to use certain tax provisions to avoid gift tax.

For example, you can apply the $16,000 annual exclusion for 2022 to the gift and pay only the remaining tax, or you can apply your gifts to the integrated lifetime credit so that you can avoid gift tax entirely on a gift in which you are.

Who Uses Form 709?

done avoid. 2022. The "annual" in "annual removal" is an important distinction. Technically, you can gift your child $16,000 on December 31, 2022, and another $17,000 on January 1, 2023, for a total of $33,000 without paying tax because the gifts were made in separate tax years.

The gift tax exemption is calculated per person, each year. For example, you could give $16,000 to your child on December 31, 2022, and $16,000 to your spouse on the same date, because the exemption is per person per year. Let's look at another example.

Source: www.101planners.com

If you give your child $16,000 to buy a car and another $16,000 to pay off his credit card debt in the 2022 tax year, you have given a taxable gift of $16,000. That's a total of $32,000 per person, so after deducting the $16,000 exclusion for the year.

you still donated $16,000 to them and you must file a Form 709 for it. The exception to the annual gift is that it is indexed to inflation and generally increases by $1,000 each tax year. Married people can split their gifts between themselves to double the annual exclusion.

Where To Get Form 709

For example, your spouse could give your child $10,000 to buy a car and another $10,000 to pay off his credit card debt. They can file Form 709 and report that they made a taxable gift — the balance between the $20,000 gift and the annual exclusion for that tax year — or they can file Form 709 and report that they made two choices

at you. gifts between you. In this case, each of you is considered to have made a gift of $10,000, each subject to the annual exclusion. No tax is due, even if the entire $20,000 is in an account in your spouse's name. The Internal Revenue Code also provides for a lifetime exemption from gift tax.

Let's say you give $30,000 to your child and you pay gift tax on the balance of that amount and the annual exclusion. If you don't want to do that, you can roll that $30,000 into your lifetime exemption. For the 2022 tax year, you can give away up to $12.06 million over your lifetime without paying any gift tax.

Source: dr5dymrsxhdzh.cloudfront.net

Source: dr5dymrsxhdzh.cloudfront.net

For the 2023 tax year, the limit is $12.92 million. But there is a catch. The federal gift tax and estate tax share this exemption, earning it the title of "unified credit." Let's say you gave away $500,000 in your life. You also have a net worth of $10 million.

How To Fill Out And Read Form 709

If you die in 2023, the value of these gifts will be added to your net worth, which is $10.5 million. Since this amount does not exceed $12.92 million for 2023, no estate tax return is required. The unlimited marital deduction includes gifts given to spouses who are US citizens.

You can give your spouse any amount you want tax-free before or after your death. Gifts to a non-US citizen spouse are taxable. The threshold is $164,000 for tax year 2022 and $175,000 for tax year 2023. Gifts in excess of this amount are subject to gift tax.

You can pay tuition or personal medical expenses without paying gift tax, as long as you pay the institution or care provider directly. Gifts to charities and political organizations are also exempt from tax. If you're not sure whether gifts you made during the year should be reported to the IRS on Form 709, consult an estate planning attorney or accountant.

No, Form 709 cannot be submitted electronically. You need to submit your Form 709 to the IRS the old-fashioned way. The IRS will only accept paper copies of this return sent in USPS postage-paid envelopes. The form cannot be filed electronically. IRS Form 709 should be mailed to the Department of the Treasury, Internal Revenue Service, Kansas City, Missouri (MO), ZIP Code 64999. Form 709 tells the IRS how you want to handle taxes.

work gift exchange form, secret santa question form, gift exchange printable forms, secret santa gift exchange forms, office gift exchange form, gift exchange information sheet, christmas gift exchange form, free secret santa template printables