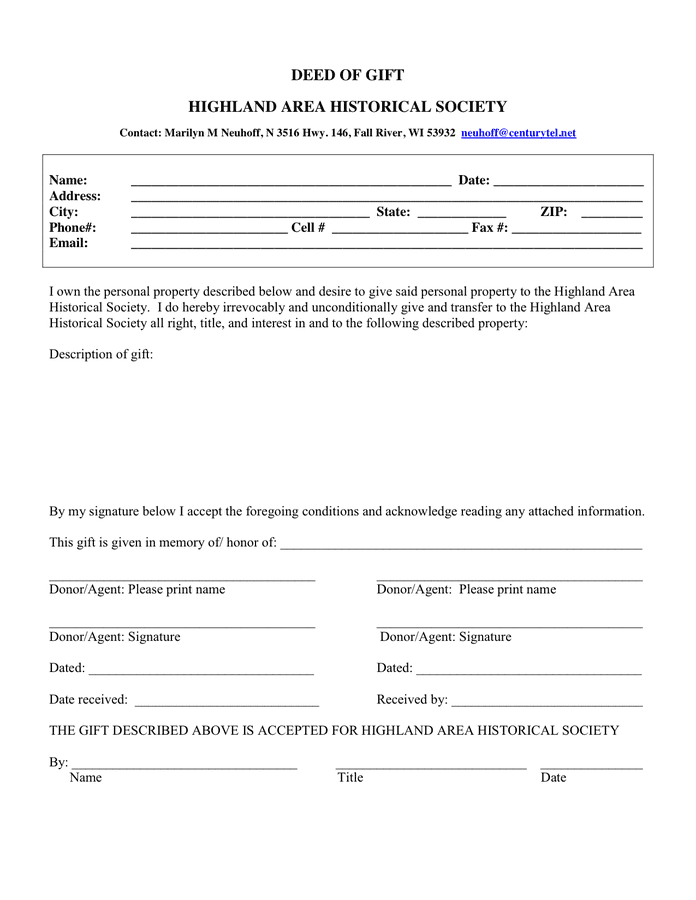

Gift Deed Form

Gift Deed Form - A deed of gift is a legal document used to transfer movable and immovable property from one owner to another for free. Its form, the types of gift deeds and the risks associated with the document are described below. Create a personalized gift card online in 5 minutes!

Source: legaltemplates.net

Gift Deed Form

Answer a few simple questions to create your document in minutes, save progress, complete on any device, download and print anytime, and the gift holder will gift it to a designated person or organization for free. Real estate, cars, personal belongings, financial assets and money can be transferred to a new owner in a deed of gift.

This document is often used to transfer property and valuables between family or friends. Charitable organizations also accept donations under gifts. There are many legal documents and procedures for someone who wants to transfer part of their property. If you decide to use a deed of gift, the estate completes documents that are clearly written and registered at the registry office.

A gift document helps make gifts of property during the owner's lifetime, as opposed to a last will, which states the intention to distribute the property after the owner's death. The risk for the person who gives his property is that he loses all rights to the property and cannot use it legally.

What Is A Gift Deed?

Suppose an aunt wants to give her house to her niece, but she wants to stay there. If you transfer the property with a gift, the niece becomes the sole owner of the property, and can sell or rent it. Khushi can allow her aunt to use the house, but she is under no legal obligation to do so.

Source: assets-news.housing.com

Tax difficulties are another risk when gifting a property with a deed of gift. There is a limit to the total amount of gifts that an employer can make each year. A house can cost more than the limit. This does not mean that the owner has to pay tax, as there are generous gift limits that only the super-rich can exceed.

In any case, a person who exceeds the annual limit must report to the state and deduct the excess amount from the lifetime limit. Failure to do so may result in penalties. The recipient of the gift does not have to pay income tax, as long as the cost of the gift is more than the life of the gift.

But he must pay tax on the income from the property. There are no limits on gifts donated to couples or charities. Suppose the niece's aunt received the house under a deed of gift and wanted to sell it immediately. When the house is sold, he has to pay income tax.

How To Use A Gift Deed?

The tax calculation is not the same as what he received after the death of his aunt in her last will. In some cases, the tax paid by the grandchild is higher. Legal forms vary from state to state, but the correct form for each can easily be found online.

Nothing thoughtful or even symbolic is included in the act of gift. This document must be registered to be legal. Homes, cars, art, stocks and money can be gifts. The value of the gift is subject to tax, but the limits are very generous. Gift vouchers cannot be canceled or returned.

Source: images.sampletemplates.com

A donor cannot revoke an irrevocable. Typically, a quitclaim deed contains a promise to transfer the property as a gift in the future so that the owner of the property can settle before a specific time or event. For example, an aunt can buy a house to be gifted to her niece when she gets married.

If the aunt does with the annulment, she can change her mind before the wedding day. If you are a large gift of cash, it is better to receive the money under the act of gift of the donor. If the document is issued, the recipient can demonstrate that the payment was made without any restriction or request for compensation.

How To Use A Gift Deed?

© 2022 Altitude Software FZ-LLC. All rights reserved. Altitude Software FZ-LLC ("FormsPal") is not a law firm and is not engaged in the practice of law. This site is not intended to create, and does not create, an attorney-client relationship between you and FormsPal. All information, documents, software and services provided on this website are for informational purposes only.

All of our contracts and legal documents are prepared and regularly updated by licensed attorneys or subject matter experts in their jurisdictions. Save your hard-earned money and time with legitimate templates. All of our contracts and legal documents are prepared and regularly updated by licensed attorneys or subject matter experts in their jurisdictions.

Save your hard-earned money and time with legitimate templates. All of our contracts and legal documents are prepared and regularly updated by licensed attorneys or subject matter experts in their jurisdictions. Save your hard-earned money and time with legitimate templates. Gift certificate of personal and family document proof Use our gift certificate to record that something was given as a gift.

Source: static.dexform.com

Source: static.dexform.com

A deed of gift is a legal document that provides formal proof that ownership of property has been donated by one party (the donee) to another party (the donee). A gift certificate is a legal document used to prove that something has been gifted to someone.

What Are The Risks Of Using A Gift Deed?

In a deed of gift, the person giving the gift (also called the "donor") swears that something will be given to the recipient (called "donate") and that no payment is expected in return. Gift certificates are often used when giving valuable items to others as gifts, and legal proof is required to transfer ownership.

If the value of the item is significant, or when you request a transfer of title or deed, the proof of gift is clear: Depending on the item, you may be able to declare that it was a gift for state or federal reasons. It can be for tax, registration or other purposes.

Common Terminology Used in Gift Certificates: For reference, this document may also read: Under an irrevocable gift certificate, gifts are not considered part of your personal property. Then you can use an irrevocable gift certificate to keep certain items and money out of contention in your last will.

A gift certificate is required when the donor voluntarily makes a gift of value to another person. It is usually used when giving a car or a large amount of money to a family member. Evidence that the donor acted voluntarily in giving. A gift certificate also certifies that the gift is not a debt, and the donor cannot claim reimbursement, refund or compensation for it.

free printable gift deed form, deed of gift of property, free printable property gift deed, property gift deed form, deed of gift form printable, gift deed for property transfer, texas gift deed form free, nc gift deed form