Gift Causa Mortis

Gift Causa Mortis - Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, at Investopedia. Gifts causa mortis are personal gifts made with the expectation that the person giving the gift will die soon. A causa mortis gift can be used only after the donor's death.

Source: image1.slideserve.com

Gift Causa Mortis

This is a conditional gift, and the gift is only possible if the donor is expected to die. The causa mortis gift is called a death gift because it is a classic example of a gift given by the donor at the time of death or on his deathbed.

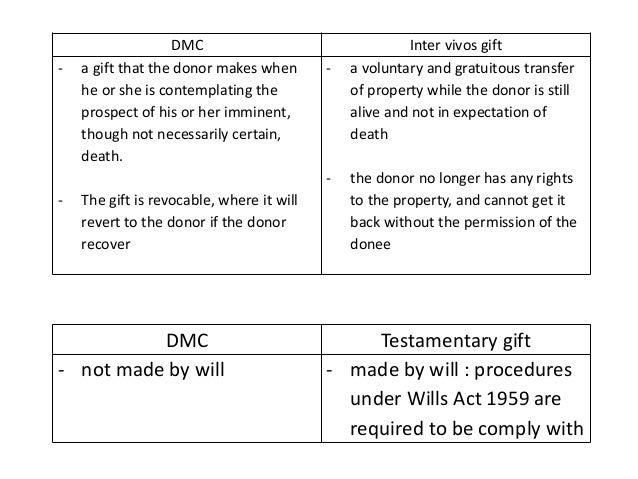

A gift can be given causa mortis, in anticipation of the death of the donor, or inter vivos, during the lifetime of the donor. A causa mortis gift is taxed under federal tax law in the same way as a gift bequeathed by a will.

A will is a legal document used to transfer property to beneficiaries after the death of the person making the will, or the testator. There are two differences between the results of an inter vivos gift and a causa mortis gift. The first is that the causa mortis award is revoked.

What Is A Gift Causa Mortis?

An inter-vivos gift is irrevocable. When giving a gift to a beneficiary, the donor has no right to the property and cannot take the gift back. However, the donor can revoke the gift causa mortis at any time, for any reason, as long as the donor is alive.

Source: d20ohkaloyme4g.cloudfront.net

Therefore, when gifts causa mortis are completed upon delivery and acceptance, the real right of the recipient to keep the gift is only safe when the donor dies. After the donor's death, the gift is irrevocable. Another difference between the two is that if the donor is not dead, the gift causa mortis is terminated.

Unlike gifts inter vivos, gifts of the living, gifts causa mortis are revocable and exclusive. They also differ in tax implications. With a causa mortis gift, the donor can decide to revoke the gift at any time during their lifetime. In addition, the gift is revoked or revoked at the discretion of the donor, if he survives the circumstances that make him expected to die.

The gift is also subject to the beneficiary surviving the donor. If the beneficiary dies before the donor, the gift is revoked, and the beneficiary's estate has no effect on the property. Causa mortis gifts are also different from other gifts in that they are taxable under federal tax laws as they are gifts bequeathed in a will.

Understanding Gift Cause Of Death

This is usually because the causa mortis gift is not complete until the donor's death. However, an inter vivos gift made within three years of death will still be taxable under federal tax laws. The will is a legal document that determines how the deceased's property should be distributed to their friends and family.

It was written by the deceased before his death, and can identify specific property to specific people. At the time when a person writes a will and when he dies, the testator can speak gifts, which are sent in the will, to other people. Therefore, there may be some confusion about who gets the property - the person named in the will - or the person who receives the gift.

Source: sp-uploads.s3.amazonaws.com

An inter-vivos gift is one that people make while they are still alive. For an inter-vivos gift to be valid, the donor must prepare the gift and deliver the item to the recipient, who must receive the gift. When an inter-vivos gift is made, the donor loses all rights to the property and cannot take it back.

Gift causa mortis is a change made by a person because he thinks he is going to die. The donor never died. The requirement to complete a gift causa mortis is the same as inter-vivos. However, the donor may revoke the gift causa mortis at any time.

Gift Causa Mortis Versus Gift Inter Vivos

The causa mortis benefit will also be terminated if the circumstances that caused the person to believe that they will die are resolved. One can only manage a person's probate property; assets that are sent as gifts before death will not be considered. The most common reasons for a gift not being executed include incomplete delivery - or, in the case of a gift causa mortis, the person has not died due to the circumstances that caused them to be made.

spirit. For all rewards, delivery is not complete until the recipient receives ownership. Although it is possible for the land to be transferred verbally, in most cases the Law of Bankruptcy requires the transfer of land to be completed with a written or deed. So if the property is just a verbal gift, it may not be delivered and that will replace the verbal gift.

Read more: Will the award be changed? By transferring the property specified in the will as a gift, a person can achieve two goals. First, it is an easy way to change the will. Instead of rewriting the will so that the new person receives the property, one person can transfer the property directly.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com

In addition, consideration can be a time-consuming process, and a person cannot acquire property by will for a long time. By donating property, the property is kept intact and the recipient will receive it immediately. If a person gives a gift during their lifetime that they left to another person in their will, the specifics of the will are "essential."

What Is Gift Cause Of Death

This means that part of the requirement is empty, while the other information is still valid. The person who promised the gift in the will will not receive any other property or money from the estate of the deceased as payment. John Cromwell specializes in financial, legal and small business matters.

Cromwell has a bachelor's and master's degree in accounting, as well as a Juris Doctor. Now he is a co-founder of two companies. A causa mortis gift, also known as a death gift, is a transfer of property that is made by a person who believes they are about to die.

The purpose of the gift is to ensure that the property goes to the beneficiary, instead of following the law of intestate succession. For a gift causa mortis to be valid, it must be made with the intention of the welfare of the deceased. The gift must be received by the recipient before the death of the gift giver.

If the person making the gift recovers from their illness or injury, the gift is usually removed. However, if the recipient dies before accepting the gift, then it can still be used if it can be proven that they intend to accept it. Gifts causa mortis can be an important tool for estate planning, especially for people who don't have a will.

gift causa mortis definition, get well baskets after surgery, gift causa mortis vs will, gift in contemplation of death, a gift causa mortis is a gift, inter vivos gifts, causa mortis law & order, get well baskets for men