Fha Gift Funds Documentation Requirements

Fha Gift Funds Documentation Requirements - RayID: 7bf58b287dbb44b4 IP: 36.82.97.81 Receipts | suitable sources | suitable donor | An alternative to save money | Summary | Questions With FHA loans, homebuyers can receive 100% of the down payment or closing cost as a financial gift—essentially a donation. As long as the gift is not a loan and is not from someone with a financial interest in the home, you can use the gift funds to purchase the home.

Source: s3.amazonaws.com

Fha Gift Funds Documentation Requirements

» SAVE: Find your agent through Clever Real Estate, get cash back when you buy! FHA gift funds are assets given by donors to cover homebuyers: No, gift funds do not have to be "spent," meaning they do not have to remain in your account for a set period of time.

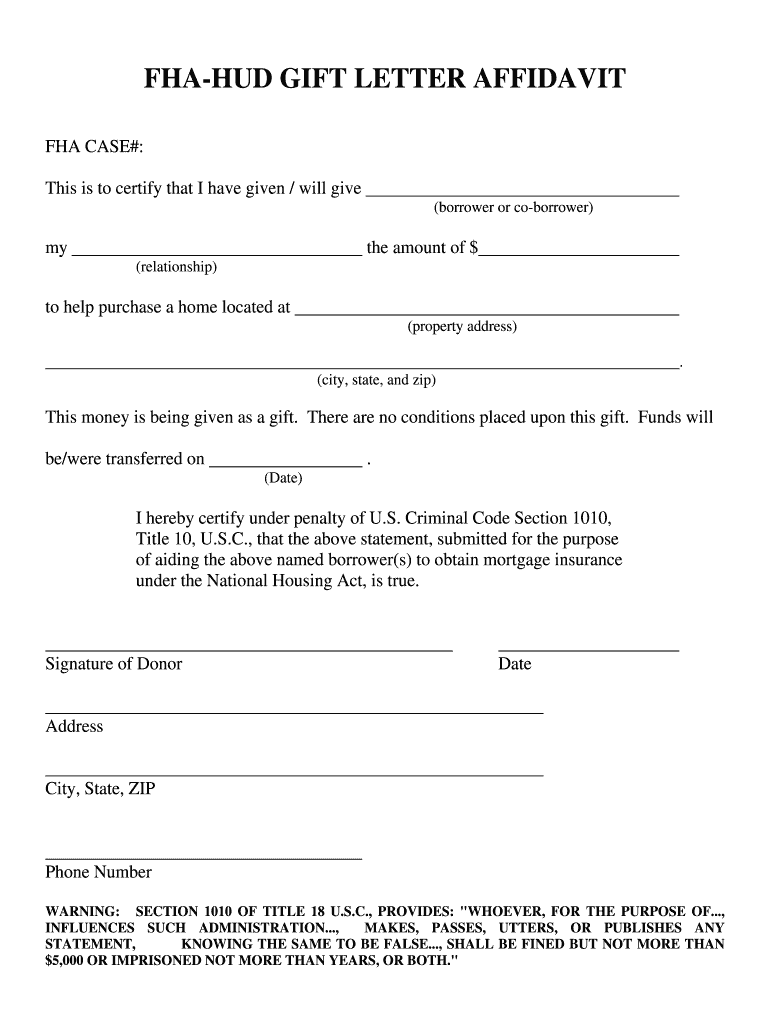

To verify that the gift funds are in fact a gift, FHA lenders require you to provide two documents: a letter of gift and a financial statement. A gift letter is an official statement from your donor proving that they are giving money with no strings attached.

The FHA wants to see a paper trail to prove the gift money left the donor bank and went to you. The documents sent depend on how your donor sent the money: electronically or by check. In general, the FHA doesn't care where the donor money came from as long as you are not obligated to repay it and it is not from someone with a financial interest in the property.

Fha Guidelines For Gift Funds

Cash is not an acceptable source of prize money. If the donor gives cash, ask them to send you an electronic transfer or give you a check (till card or certificate). The FHA is also strict about who can gift money. Eligible donors include anyone who has an interest in you - but not in buying the home (ie they cannot have a financial interest in the property).

Source: activerain.com

If you don't have secure gift money, you can also get help with the down payment from: Co-borrower who pays the monthly mortgage with you – his name is on the title and he's allowed to live in the house. A co-signer's income counts toward the debt-to-income ratio.

Higher total income lowers your DTI and can help you earn less. If you're buying your first home, you can apply for one of 2,500 grants, down payment or completion help, and loan programs for first-time home buyers in the United States. Yes, the FHA allows gift funds for down payments and closing costs.

from donors interested in borrowing – such as family members, close friends, employers, charities and government agencies. Yes, gift credits can be used toward most home purchase expenses. A higher cash reserve or emergency savings can help you qualify for FHA if you have a high debt-to-income ratio.

Fha Guidelines For Gift Funds

Ratio (DTI). In general, the FHA doesn't care where the donor's money came from. As long as you are not obligated to make repayments and it is not coming from someone with a financial interest in the property, your FHA lender will accept gift funds from your business account.

Yes, FHA requires a gift letter and financial statements to show the money is from the donor to you. No, the prize fund cannot be withdrawn. There must be a paper trail, be it an electronic transfer or a check. © 2022 Estimate anytime. All rights reserved - Privacy Policy |

Source: nationwidemortgageandrealty.net

Terms and Conditions | Consent to Contact Customers | TREC Consumer Protection Notice | About Brokerage Services We have started a new series of blog posts that will answer some of the most frequently asked questions about FHA insured mortgage loans. Now the question is: Can a family member make an FHA down payment in 2017?

The short answer is yes, as of 2019, the minimum down payment required for an FHA loan (ie 3.5%) can be provided by a family member, friend, employer or other approved source. This is all detailed in HUD Manual 4000.1, Single Family Home Policy Manual.

Do Fha Gift Funds Need To Be Seasoned?

Now that we've got that simple answer out of the way, let's take a closer look at FHA deposit rules and procedures. According to the Department of Housing and Urban Development, which administers the FHA loan program, borrowers are required to make a minimum 3.5% down payment when using this program.

More specifically, it's 3.5% of the home's purchase price or appraised value, whichever is lower. This relatively low deposit is part of what draws people to the program. The good news is that this upfront investment doesn't have to come out of the homebuyer's pocket.

FHA deposits may be made by family members or other approved donors as defined in the 2017 HUD Policies and Requirements. For this reason, this program is very popular among middle- and low-income borrowers (although, of course, it is not limited to them). this. Group).

Source: www.pdffiller.com

Source: www.pdffiller.com

In the FHA Policy Manual, HUD defines a gift as "a gift of cash or equity with no expectation of repayment." The last four words are critical. If a family member, employer, or other approved donor provides funds toward the mortgage payment, no repayment is expected.

Possible Sources:

This means that the gift must actually be a gift and not a loan. You can give yourself money, but you cannot borrow it from others. Per HUD Manual 4000.1, the FHA down payment gift may be provided by: Our understanding that the seller may contribute money toward the buyer's closing costs, but not the down payment.

HUD considers sellers, real estate agents, builders and developers to be "parties with an interest in the transaction". And these prospects are not allowed to contribute money to the minimum investment required by the borrower or MRI. This corresponds to HUD manual 4000.1 (page 232).

So we've answered the main question: Can an FHA deposit be paid by a third party? The answer is yes, as long as the person donating the funds is listed in the Approved Donors list above (and also in the HUD Handbook). There are additional requirements for the 2017 FHA down payment gift. The mortgage lender funding the loan must receive a "gift letter" from the borrower.

This letter should at least state that the donor does not expect any repayment as stated above. You should also specify the nature of the relationship. If all or part of your down payment is being paid by a third party, your mortgage lender must properly document the transfer of funds before closing.

fha acceptable gift family members, fha gift documentation guidelines, fha loan gift funds guidelines, fha gift letter, fha gift guidelines 4000.1, fha gift letter requirements, fha gift of equity guidelines 2022, fha gift of equity guidelines