Fannie Mae Gift Funds Documentation

Fannie Mae Gift Funds Documentation - Saving enough for a down payment is one of the biggest challenges home buyers face. Asking family members to contribute to the down payment is one option to consider, especially if the economic downturn is making saving difficult. But there is a caveat to giving money to family members to buy a home: the money must be properly documented with a prepaid gift letter.

Source: www.sammamishmortgage.com

Fannie Mae Gift Funds Documentation

According to a 2020 National Association of Realtors survey, 26% of first-time buyers and 7% of repeat buyers say saving for a down payment is the most difficult part of the home buying process. However, before you accept a prepaid gift mortgage, there are a few rules to know: The same rules apply when giving money to family members when it comes to who can receive down payment gifts.

You can get a prepaid gift from your parents, siblings or other relatives, or you can get a gift through an approved agency. This may include mortgage assistance programs offered by state governments or non-profit organizations. Fannie Mae and Freddie Mac guidelines offer prepayment gifts on conventional mortgages.

Gifts can come from: If you buy one to four homes to use as a primary residence or second home, the entire down payment can come from the gift fund. Loan-to-value ratio must be 80% or less. If you're buying two to four homes or using a Fannie Mae mortgage, if you're buying a second home with an LTV above 80%, you'll need to pay a minimum of 5% down.

Down Payment Gift Guidelines

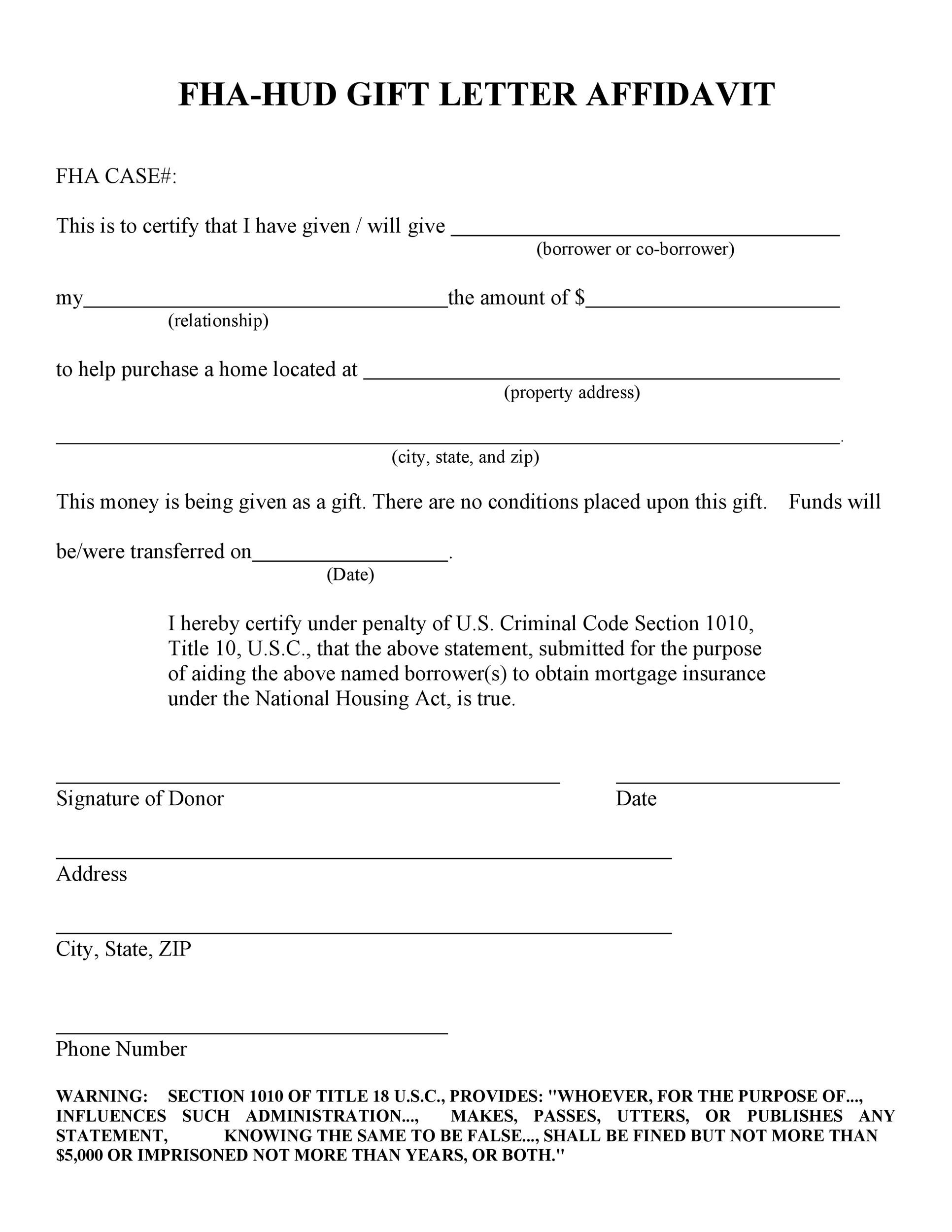

Freddie Mac mortgages require a minimum of 5% from the borrower when the loan is secured by a second home and the LTV is greater than 80%. The minimum down payment required for an FHA loan is 3.5% with a credit score of 580. According to the Single Family Home Policy Guide, down payment gifts can be received from the following sources: The money given by one of the above sources must be a down payment claim.

Source: www.pdffiller.com

qualify as a gift. VA loans are designed to make home buying more affordable for veterans and their families. A VA loan requires no down payment. If you want to reduce the amount you need to finance, you can use gift money to put money towards a home purchase.

Like VA loans, USDA loans require no down payment for those who meet certain income qualifications. But you can put down a gift payment at the closing table to reduce the amount you need to finance. Although USDA and VA loans do not require a down payment, you must meet minimum credit score criteria to qualify.

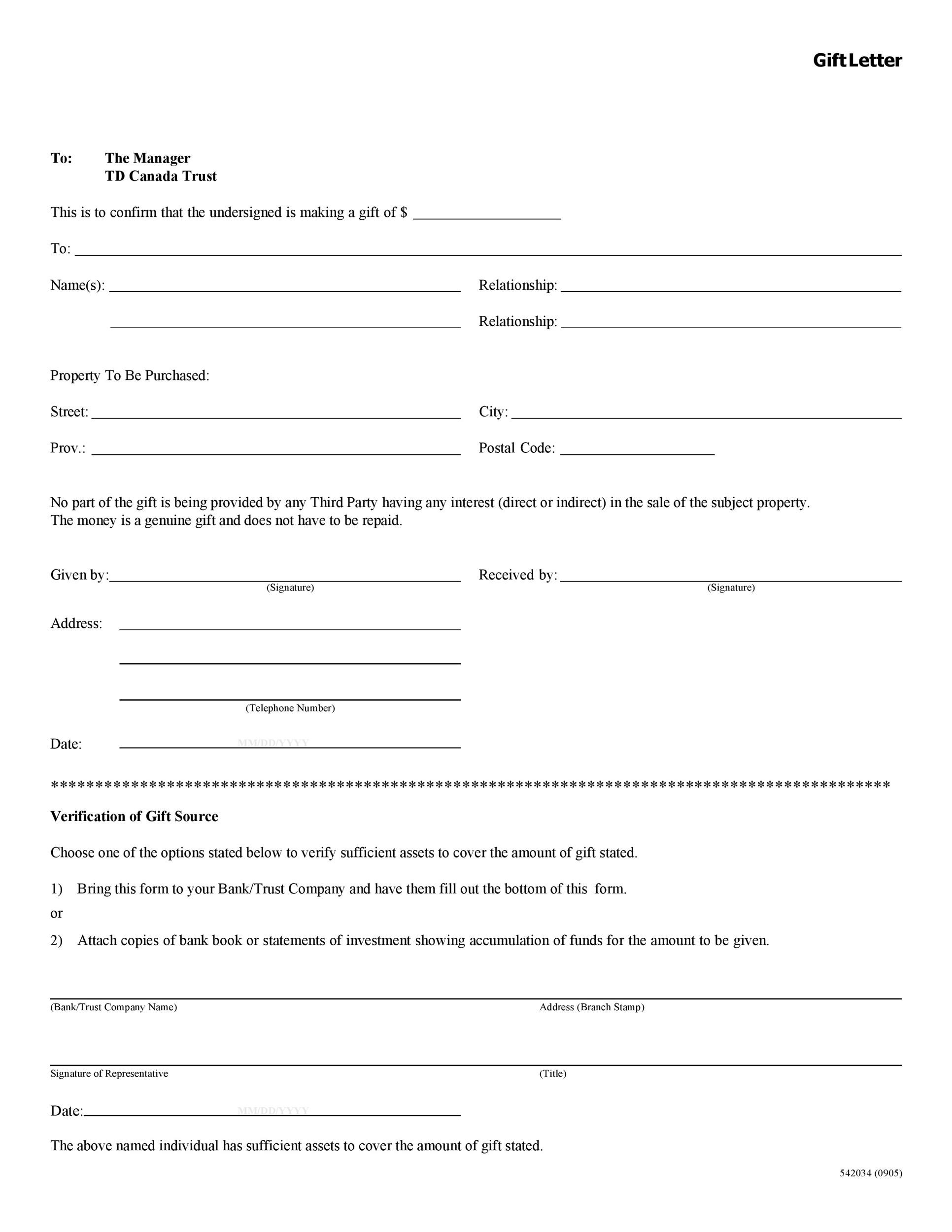

If you buy a home using gift money, you need a prepaid gift certificate. With conventional loans, your mortgage payment letter must include the following: You and the donor must sign a prepayment gift letter. It should also be dated. It should include the date the gift was given to you or, if the money has not yet been transferred, it will be given to you.

Down Payment Gift Rules: Conventional Loans

Ask your lender if they have a special pre-paid gift letter template you can use. It is important to have a paper trail showing the transfer of funds from the donor's account to your account. Fannie Mae lists the following four methods of writing used for standard loans: The borrower must provide proof of a certified check, cashier's check, or other official check to the lender agent, and the advance will be closed if it is not transferred before settlement.

Regardless of the amount of the gift, there is no tax liability for you as the recipient of the advance payment. But the person giving you the gift may trigger gift tax if the amount exceeds the annual limit. For example, parents who married in 2021 and made a joint gift of up to $32,000 to each child for a mortgage loan (or for any other purpose) could be gift tax-free starting in the 2022 tax year.

Source: templatelab.com

Source: templatelab.com

That's over $30,000. In 2021. The gift tax exclusion limit for single filers is $16,000. Weigh the pros and cons of accepting down payment gifts when buying a home. Once you know what you need for a mortgage and a down payment, consider other options for raising the money you need to buy a home.

Are you eligible for a unpaid VA or USDA loan? Try the pros and cons of getting an FHA loan with 3.5% down. You can also extend your shopping time and work on saving money. Alternatively, you may decide to sell your belongings or start a business or business to earn money that you can save.

Down Payment Gift Rules: Fha Loans

Payment assistance programs are another option. These programs can provide grants and financial aid to help you pay down payments and, in some cases, closing costs. But there are eligibility rules. A quick online search can help you find these programs in your area. Payment assistance programs may require you to live in the home for several years to receive assistance.

The source and size of the gift is more important than the method of giving it. As for how to receive the gift, it is important to have documents to prove where the money came from. This could be a check, a copy of a check that shows how much money your parents received, or something similar to prove how much and where the money came from.

The top rate of gift tax is 40% starting in 2021. However, this only applies to gifts of $1 million or more that are tax-free. The first $10,000 over the tax-free limit is taxed at 18%. For more information on how gifts may be taxed, see the Internal Revenue Service's instructions for Form 709.

Source: templatelab.com

Source: templatelab.com

National Association of Realtors. "2020 Down Payment Expectations and Barriers to Home Ownership," page 9. Funds held in checking, savings, money market, certificate of deposit or other Savings accounts can be used for down payment, closing costs and backup financing. Funds must be verified as described in B3-4.2-01, Verification of Investments and Assets.

Down Payment Gift Rules: Va Loans

Unverified funds are not accepted for down payment, closing costs or backup financing. The lender must check the properties of the loaned property. These should be defined differently depending on how the asset account is defined. Business assets can be a source of suitable funds for down payment, closing costs and financial reserves.

The borrower must be identified as the owner of the account and the account must be verified in accordance with B3-4.2-01, Verification of Deposits and Assets. If the borrower is using income from this business to qualify, see Section B3–3.2, Self-Employed Income, for more information on the borrower's self-employment analysis.

A large investment is defined as an investment exceeding 50% of the gross monthly income eligible for credit. When bank statements (usually covering the most recent two months) are used, the lender should evaluate large deposits. See B3-4.1-04, Virtual Currency, for additional information on when a significant investment may be in virtual currency converted to U.S. dollars.

As shown in the table below, the requirements for large investment appraisals vary depending on the type of transaction.

fannie mae gift donor guidelines, fnma gift of equity, fnma gift funds, fannie mae gift donor eligibility, fnma gift funds guideline, freddie mac gift donor guidelines, conventional loan gift funds guidelines, fannie mae gift guidelines